Many investors are wondering about the current status of this digital asset. It has seen a big drop in price from its highs. The journey of this token has been tough, hitting its all-time peak of $0.1211 in June 2021.

Now, it trades around $0.004 with a market cap of $351 million. The project is under a lot of scrutiny. This cryptocurrency collateral token works in the Flexa Network, making instant payments to many merchants.

Recent updates show the network is working, even with market challenges. Looking at trading volume and network activity helps us see if it’s relevant today.

We’re looking at the challenges and chances for this payment token. It’s not just about the price. We need to see how useful the network is and how many people use it.

Understanding AMP and the Flexa Network

AMP is a special token in the Flexa payment system. It’s different from regular cryptocurrencies that are mainly used for payments. It helps link digital assets to traditional payment methods safely.

The Purpose of AMP in Digital Payments

AMP’s main job is to make sure cryptocurrency payments are settled quickly. When you use digital assets to pay through Flexa, AMP tokens are used as digital payments collateral. This means merchants get their money right away.

This solves a big problem with blockchain: how long it takes to confirm payments. Traditional crypto payments can be slow, making merchants unsure. AMP fixes this by covering the payment value immediately and then settling it later.

AMP shows a smart way to use erc-20 token utility. It makes businesses trust digital currency payments more. They know their money is safe, even when other cryptocurrencies are unstable.

How the Flexa Network Utilises AMP

Flexa uses AMP in a complex system built on Ethereum. It splits collateral for different payments, making sure each one is covered. This open system lets everyone see how payments are secured.

When you pay with crypto, AMP tokens are locked to cover the payment. This is done through smart contracts that act as insurance. Once the crypto payment is confirmed, the AMP tokens are released back into the pool.

The Flexa network supports many cryptocurrencies and ensures merchants get paid in their preferred way. This has made businesses more likely to accept digital payments. The network is always improving, like Flexa Capacity’s move to AMP, making AMP even more useful.

This new way of using tokens is a big step forward for payment security. It separates the payment asset from the guarantee, making digital commerce safer. This shows how special tokens can solve real problems in blockchain adoption.

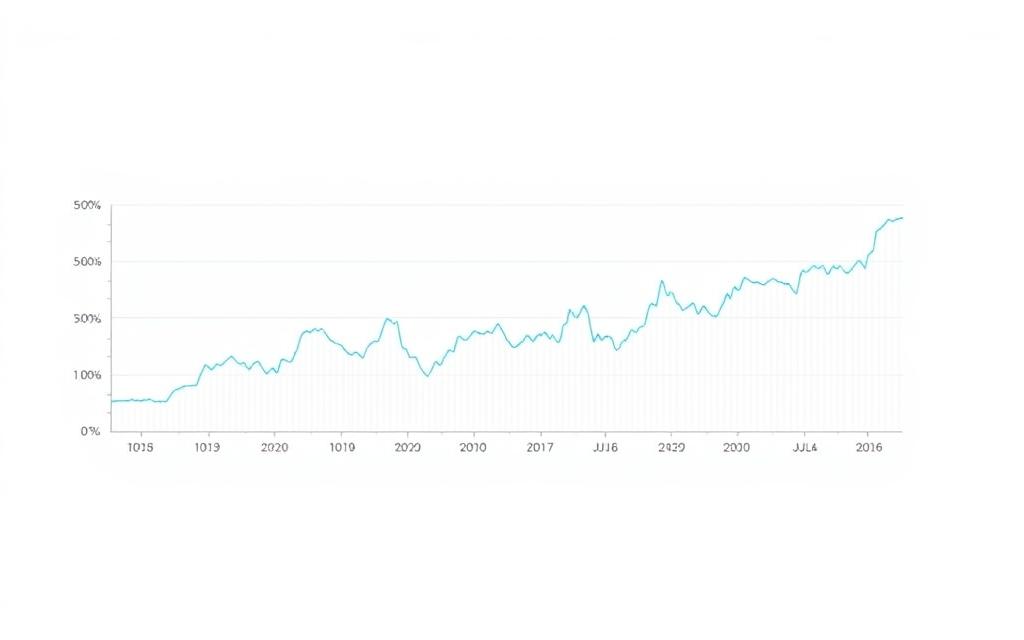

Historical Context of AMP’s Market Performance

To understand AMP’s current status, we need to look at its journey through market cycles. Its price history shows patterns that help investors see its growth and resilience.

Price Trends and Capitalisation Over Time

AMP started trading in a very volatile time for cryptocurrencies. It hit an all-time low of $0.0007946 in November 2020. This was the start of building the Flexa Network.

The 2021 bull market saw AMP soar. By June 2021, it reached $0.1211, showing huge growth. This rise was due to market excitement and network updates.

After the peak, AMP went through a typical correction. Its price fell in 2022 and early 2023. This was due to economic and sector challenges.

Recently, AMP has shown signs of recovery. It hit a 2024 peak at $0.01189, showing renewed interest. Now trading around $0.004, it suggests it can grow in good market conditions.

Significant Events in AMP’s History

Several key events have shaped AMP’s market and value. These Flexa Network milestones are important in the project’s growth.

The network grew through partnerships with big retailers. Deals with GameStop and Nordstrom added real-world value. These partnerships often led to price increases.

Technical upgrades have improved the network. Faster transactions, better security, and more interoperability have boosted AMP’s value in digital payments.

Regulatory changes have also affected AMP’s market. How it reacts to new rules shows its compliance and long-term outlook.

AMP’s price movements show interesting patterns. It sometimes moves with major cryptocurrencies, but also on its own. This helps understand its market position and investor mood.

AMP’s performance in tough times is also telling. How it handles liquidity crises and market downturns shows its risk and recovery abilities.

Recent Updates and Developments for AMP

The Flexa Network is growing fast with new projects and tech upgrades. In recent months, it has made big steps in infrastructure and real-world use. This puts AMP in a good spot for growth in digital payments.

Technical Enhancements and New Integrations

Flexa has updated its SDK and API for developers. This makes it simpler to add AMP payments to apps. Now, transactions are faster and safer.

The network has also improved mobile wallet and NFC payments. This means you can use cryptocurrency for contactless payments in stores. It connects digital money to everyday shopping.

Future plans include adding DeFi features and DAO governance. These will let AMP token holders have more say in the network. It will also make AMP more useful than just for payments.

Adoption Rates and Merchant Partnerships

AMP’s merchant partnerships crypto efforts have paid off. It’s now accepted in thousands of stores worldwide. This shows more businesses are open to cryptocurrency payments.

The network is also growing in Latin America and Southeast Asia. These areas are great for mobile payments because they have high adoption rates.

Adoption numbers are going up, with more merchants and transactions. While numbers change, the trend is clear. AMP is being used more for instant payments.

New partnerships with payment processors and retailers show trust in Flexa’s tech. These deals aim to make cryptocurrency payments fast and secure for businesses.

The network is also moving to proof-of-stake with Ethereum. This makes AMP more appealing to those who care about the environment. It’s good for eco-friendly businesses and users.

Current Market Data and Analysis for AMP

Looking at AMP’s market position gives us key insights. It shows how it trades and competes. The token’s performance metrics help investors and analysts understand its place in the crypto world.

Trading Metrics and Liquidity Conditions

AMP trades at $0.004169 with a 24-hour volume of $35.81 million. This volume shows a lot of market activity. It means traders are interested, even with price changes. The market cap is $351.19 million, placing AMP in the middle of crypto values.

Technical indicators give mixed signals for AMP’s short-term price. The Relative Strength Index (RSI) is 75.69, which might mean a price drop is coming. The Moving Average Convergence Divergence (MACD) shows a bearish crossover, hinting at possible downward pressure soon.

Liquidity analysis across major exchanges shows good depth in order books. But, some platforms have thinner trading pairs than others. This cryptocurrency liquidity analysis shows AMP has good market access. But, big trades might see slight slippage on certain exchanges.

“Market indicators for payment tokens often show heightened volatility during periods of technological transition, making current readings very important for long-term positioning.”

Competitive Position Among Payment Tokens

AMP is in a crowded field of payment-focused cryptocurrencies. Each offers different ways to handle digital transactions. When comparing payment tokens, several key competitors stand out with unique value propositions and market positions.

Ripple (XRP) focuses on big cross-border payments with banks. Stellar (XLM) aims for low-cost transactions for users and micro-payments. Chainlink (LINK) is mainly an oracle network but has entered payment solutions through cross-chain capabilities.

The table below shows how AMP compares with these major competitors in key areas:

| Token | Market Cap | Transaction Speed | Average Fee | Merchant Adoption |

|---|---|---|---|---|

| AMP | $351.19M | Instant | $0.0001 | 2,500+ |

| XRP | $28.5B | 3-5 seconds | $0.0002 | 100+ institutions |

| XLM | $2.8B | 3-5 seconds | $0.00001 | 4M+ users |

| LINK | $8.4B | Varies | Network dependent | 1,000+ projects |

AMP’s main advantage is its collateralisation model through the Flexa Network. It offers instant settlement guarantees for merchants. This is different from competitors who focus more on payment processing.

Current market competition analysis shows AMP has a smaller market share than big players. But, its special collateralisation function creates a unique niche. Its focus on payment security is both its strength and challenge in gaining wider recognition.

Adoption in the financial sector is growing, with more retailers wanting fraud protection. But, institutional adoption is lower than established networks. This shows both growth chances and current limits.

Key Factors Affecting AMP’s Future

AMP’s past success and current market status are important. But, its future depends on several key factors. These will decide if AMP becomes widely used and keeps growing in the digital payments world.

Regulatory Considerations and Compliance Issues

The cryptocurrency regulation impact is a big factor for AMP’s future. Laws around digital assets are changing, bringing both chances and challenges for AMP.

In the US, digital assets are under closer watch. The Securities and Exchange Commission’s views on crypto could greatly affect AMP’s legal standing.

Flexa Network is taking steps to meet compliance issues crypto faces. They’re setting up systems to follow financial rules, showing they’re serious about legal operation.

The European Union’s crypto rules add more complexity. The Markets in Crypto-Assets framework could help AMP grow or pose more hurdles, depending on how it’s applied.

Technological Innovations and Future Hurdles

AMP needs to keep improving its tech to stay ahead. It faces future challenges amp must tackle to stay relevant in the fast-changing blockchain world.

New technological innovations blockchain brings could help or hinder AMP. Its plans to join DeFi could make it more useful than just for payments.

Scalability is a big problem for many blockchain projects. AMP must be able to handle more transactions without slowing down or losing security. This is key for merchants and users.

There’s also tough competition from big names in payments. Traditional banks and tech giants are making their own digital payment systems. AMP must stand out with better tech and benefits for users.

Being able to work with different blockchain systems is also vital. AMP’s success depends on its ability to connect with various blockchain and traditional finance systems. This will help it in different payment situations and markets.

Is AMP Crypto Dead? Evaluating the Current Status

A thorough amp viability assessment looks at numbers and opinions from the crypto world. It’s more than just looking at prices. It checks if the project is healthy and has a future.

Evidence of Ongoing Activity and Development

Several project activity indicators show AMP is working hard, even when the market is tough. The GitHub shows constant updates, with developers making the network better. This shows they’re investing in the future.

In 2023 and 2024, the network got better with new upgrades. These updates fixed security issues and made transactions faster. The team’s steady updates show they’re well-organised.

AMP is getting more merchants on board, but at a slower pace than before. New partnerships with payment systems show the project is growing. These partnerships prove AMP is useful in real life.

Transaction numbers on the network are up and down but keep going. It’s not growing fast, but it’s steady. This steady use is a good sign for AMP’s future.

Community and Expert Perspectives on Viability

The cryptocurrency community sentiment about AMP is mixed but active. Thousands talk about AMP on Telegram and Reddit. They share news and ideas, showing they care about more than just the price.

Staking rates are steady, showing people believe in AMP’s future. This locked value helps keep the network safe and shows support from current holders.

Expert opinions crypto analysts have different views on AMP. Some see the ongoing work and real uses as hopeful signs. They think AMP is special in the payment world.

“AMP’s way of working with money is needed, and they’re making progress for the long run, not just quick gains.”

But, others are more careful, worried about competition and rules. They say it’s hard for payment cryptos to grow. They worry about how many people will use it, not just its tech.

Overall, AMP seems to be in a phase of change, not dying. It has enough support and work to stay relevant. But, it needs big steps to be widely used. This makes it hard to say for sure if AMP will succeed.

Conclusion

Our detailed study shows AMP is actively being developed in the Flexa Network. It’s not just for making payments. It also offers collateralisation services, making it stand out from others. This keeps it relevant, even when markets are shaky.

Looking ahead, AMP’s price could vary a lot. It might hit $0.0056 by 2025 or soar to $10.36 by 2040. These predictions highlight both the current hurdles and the big future possibilities. The growth of the Flexa Network, through more merchant partnerships, could greatly affect these predictions.

In our final thoughts, AMP brings a fresh take to digital payments but faces challenges. We see it as a cautious bet. It has real value but the rules and competition are uncertain. For those thinking about investing in cryptocurrencies, AMP offers a unique chance with both risks and rewards in the changing payments world.

FAQ

What is AMP cryptocurrency and how does it relate to the Flexa Network?

AMP is an ERC-20 token used in the Flexa Network. It acts as collateral for instant transaction settlement. It doesn’t directly handle payments but ensures they are secure and fast for merchants.

How has AMP performed historically in terms of price and market capitalisation?

AMP hit its peak in 2021, then fell during the bear market. Its value has been shaped by crypto trends, partnerships with big names, and network updates. It has seen ups and downs.

What recent developments or upgrades has the AMP ecosystem seen?

AMP has seen updates, better tools for developers, new partnerships, and expansion plans. The Flexa Network is also working on DeFi, faster transactions, and aligning with Ethereum’s shift to proof-of-stake.

What is AMP’s current market position and how does it compare to competitors?

AMP is unique as a collateral token for payment assurance. It differs from direct payment tokens like Ripple and Stellar. Its edge is in reducing settlement risk, but it faces competition and must show its value and adoption.

What factors could impact AMP’s future viability and growth?

AMP’s future depends on regulatory changes, tech execution, scalability, and adoption in digital payments. Macroeconomic trends and competition from other blockchain systems also matter.

Is there evidence that AMP and the Flexa Network are actively developing?

Yes, there’s ongoing work like updates, new partnerships, community engagement, and developer contributions. Experts see both promise and challenges for wider adoption.

How does AMP’s tokenomics and use as collateral work in practice?

AMP tokens are used as collateral for secure transactions on the Flexa Network. This makes payments instant and fraud-resistant for merchants. Token holders can stake AMP to earn rewards, helping the network.

What are the main risks associated with investing in or using AMP?

Risks include regulatory uncertainty, market volatility, competition, and the need for more adoption. Success also depends on tech execution and scalability in the evolving blockchain world.